| Mandalika's scratchpad | [ Work blog @Oracle | My Music Compositions ] |

Old Posts: 09.04 10.04 11.04 12.04 01.05 02.05 03.05 04.05 05.05 06.05 07.05 08.05 09.05 10.05 11.05 12.05 01.06 02.06 03.06 04.06 05.06 06.06 07.06 08.06 09.06 10.06 11.06 12.06 01.07 02.07 03.07 04.07 05.07 06.07 08.07 09.07 10.07 11.07 12.07 01.08 02.08 03.08 04.08 05.08 06.08 07.08 08.08 09.08 10.08 11.08 12.08 01.09 02.09 03.09 04.09 05.09 06.09 07.09 08.09 09.09 10.09 11.09 12.09 01.10 02.10 03.10 04.10 05.10 06.10 07.10 08.10 09.10 10.10 11.10 12.10 01.11 02.11 03.11 04.11 05.11 07.11 08.11 09.11 10.11 11.11 12.11 01.12 02.12 03.12 04.12 05.12 06.12 07.12 08.12 09.12 10.12 11.12 12.12 01.13 02.13 03.13 04.13 05.13 06.13 07.13 08.13 09.13 10.13 11.13 12.13 01.14 02.14 03.14 04.14 05.14 06.14 07.14 09.14 10.14 11.14 12.14 01.15 02.15 03.15 04.15 06.15 09.15 12.15 01.16 03.16 04.16 05.16 06.16 07.16 08.16 09.16 12.16 01.17 02.17 03.17 04.17 06.17 07.17 08.17 09.17 10.17 12.17 01.18 02.18 03.18 04.18 05.18 06.18 07.18 08.18 09.18 11.18 12.18 01.19 02.19 05.19 06.19 08.19 10.19 11.19 05.20 10.20 11.20 12.20 09.21 11.21 12.22 02.26

Inflation is the persistent rise in the prices of goods and services in an economy over a period of time, leading to a reduction in the purchasing power as each unit of currency buys fewer goods and services.

Price inflation is measured by the inflation rate, the percentage change of prices calculated on a monthly or annual basis in a price index. Around the world, the Consumer Price Index (CPI) is the most commonly used index to calculate the inflation rate, which measures the price of a representative selection of goods and services for a typical consumer. For example, if the inflation rate is measured at 5%, a loaf of bread that costs $1 today will cost $1.05 in a year.

What causes inflation?

There are at least three theories that are generally accepted.

-

In a booming economy, strong consumer demand for goods and services may outweigh the aggregate supply and cause the price levels to rise. In other words, if demand is growing faster than supply, prices will increase. This is often referred as Demand-Pull Inflation, a term mostly associated with Keynesian economics.

Most modern asset bubbles including the U.S. housing bubble which peaked in 2006 fall into this category. The increase in the value of Gold in the aftermath of 2008 financial crisis is another example.

-

An increase in prices of inputs like wages, taxes, imports and raw materials, or other influential factors such as natural disasters, depletion of natural resources, government regulation, change in exchange rates etc., may push the costs of production higher and weaken the supply of goods as it becomes more expensive now to make the same volume as they were before the surge in production costs. While the demand for these goods remain consistent, the shortage in supply causes a rise in the overall price level. In other words, inflation happens when costs increase independently of aggregate demand. This type of inflation is referred as Cost-Push Inflation, another term associated with Keynesian economics.

In 2011, the earthquake and tsunami disaster caused inflation to go up temporarily in deflation-ridden Japan.

As the push for higher federal minimum wages has gained momentum in U.S. these days, the naysayers often cite references to cost-push inflation -- they argue that if the base wages are raised, the manufacturers may feel obligated to pass these increases onto consumers in the form of higher prices.

-

Over expansion or increase in the money supply in the form of cash and credit may create inflation. If a country prints too much money, the value of the money decreases proportional to the amount of money that was printed. Despite no changes to the aggregate demand or supply, having too much money chasing too few goods can cause the prices of just about everything to increase. If too much money is printed, it becomes worthless to the point where objects are exchanged for goods in place of paper money (bartering).

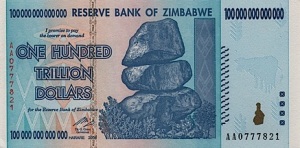

In year 2000, Zimbabwean Government engaged in money creation activity to fund the Congo war. Coupled with the fact that the money was created with nothing to back it up to give it a value, droughts and private farm confiscation by the government further weakened the supply of food and other locally produced goods. Eventually people holding the Zimbabwean dollar (symbol: Z$) lost confidence in its ability to retain its value, and the series of events that followed led to prolonged hyperinflation between years 2004 and 2009, which ultimately ended with the demise of the Zimbabwean dollar in April 2009. The peak month of hyperinflation occurred in mid-November 2008 with a rate estimated at 79.6 billion percent per month.

Hyperinflation is not purely a monetary phenomenon — massive supply shock often coupled with external debt denominated in a foreign currency may create a situation involving social unrest that give rise to hyperinflation. A supply shock is an event that suddenly changes the price of a commodity or service mostly due to wars or natural disasters. The collapse of the Austro-Hungarian Empire, Yugoslavia, and the Soviet Union all led to the emergence of hyperinflation.

Source: various including investopedia, wikipedia, economicshelp.org, James Montier’s writings

(To be continued ..)

Labels: Economics Inflation

| 2004-2026 |